Internal rate of return (IRR) and return on investment (ROI) are two of the common calculations rental property investors use to analyze and forecast their actual and expected returns.

In this article we’ll look at the differences and similarities between IRR and ROI.

Definition of IRR and ROI

IRR and ROI are two complementary calculations used by real estate investors. The biggest difference between the two formulas is that IRR considers the time value of money (TVM) while ROI doesn’t.

You’ve probably heard the expression, “A bird in the hand is worth two in the bush.” That’s exactly what the time value of money is all about.

According to the TVM concept, money today is worth more than the same amount of money at a future date. That’s because cash today can be invested immediately to generate earning power that has a compounding effect on the original amount invested.

On the other hand, the promise of money at a future date carries a certain amount of risk, which is one of the reasons that borrowers pay interest on loans to lenders.

Now, let’s look at how ROI and IRR are calculated.

Return on Investment (ROI)

As we mentioned above, ROI doesn’t factor in the time value of money. What ROI does measure is the change in property value at the present time compared to its original value:

- ROI = Net income + Current value / Original value – 1 x 100

- $50,000 NOI + $250,000 current value / $200,000 original value = 1.5 – 1 = 50%

In this example, a rental property now worth $300,000 that was originally acquired for $200,000 has a return of investment of 50%. However, ROI doesn’t take into account two important factors that IRR does:

- Length of the property holding period

- When the net income cash flows are received

Internal Rate of Return (IRR)

Rental property investors use IRR – which is another term for “annualized return” – to measure the cash flows generated by investments over holding periods longer than one year.

The IRR formula is also used by professional investors such as hedge funds, private equity, and single-family rental property investors to measure the annual growth of an investment while factoring in the time value of money. IRR is a good calculation to use when comparing alternative investments to one another.

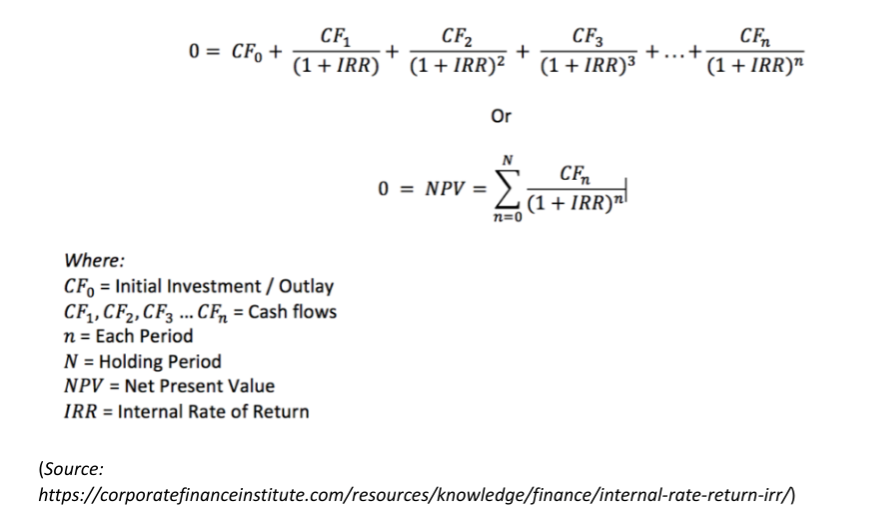

Calculating IRR is complex and should be done using Excel, a financial calculator, or an online IRR calculator like Roofstock’s Cloudhouse Calculator:

Note that the IRR calculation is used to determine the specific discount rate that makes total cash inflow equal to the net present value (NPV), or the initial amount of net cash invested.

The formula for determining net present value is: NPV = Cash inflows / (1 + i)t – Cash outflows, where i = the required discount rate and t = the number of cash flow periods.

If the NPV is positive — in other words, if the projected future discounted cash flows are greater than the cost of the investment — investing in the property makes sense. By applying the same discount rate to alternative investment options, the investor can also determine which property will create the highest NPV — or the largest amount of cash.

Discount rate can also be thought of as representing an investor’s return for a safe or relatively risk-free investment. So, if an investor can safely earn an IRR or annualized return of 4%, an alternative investment would need to offer an IRR greater than 4% to make financial sense, everything else being equal.

Because IRR also takes into account the time value of money, the longer an investment is held the lower the IRR will be. ROI will be the same, whether a property is held for one year or 100 years because the calculation assumes net income cash flows are received as one lump sum.

For example, a property purchased for $200,000 that is worth $300,000 after one year would have an ROI of 50% and an IRR of 50%. However, after a 5 year holding period the IRR may only be 12% (due to TVM) while the ROI would still be 50%.

Return of Investment vs. Return on Investment

At this point it’s worth noting that there’s a big difference between return of investment and return on investment.

When people invest in an asset – stocks, bonds, or real estate – they automatically assume they’ll receive 100% of their initial capital invested back at some point. That’s the return of investment. The return on investment includes the initial capital invested plus net profits earned from owning the asset.

Experienced investors know that choosing the wrong investment can result in a loss of investment, with not all of their initial investment being returned, not to mention having absolutely no return on investment. For example, the value of stocks can dramatically rise and fall over a short period of time.

That’s a big reason why single-family rental property investors turn to the Roofstock Marketplace. Every property listed for sale on Roofstock includes a complete financial proforma including metrics such as gross yield, cap rate, cash on cash return, and IRR (annualized return) over a 5-year holding period.

The turnkey rental properties on Roofstock allow real estate investors to mitigate risk and help maximize ROI (return of and on investment) with rental income that begins right after closing, a vetted local property management team to manage operations and help increase property value, with continued support and training from Roofstock.

Choosing Between IRR or ROI

IRR calculates the annualized growth rate while taking into account the time value of money. ROI measures the growth rate or total return from the beginning to the end of the investment period but doesn’t consider when income is received.

Other key differences between IRR and ROI include:

- IRR calculates annualized return while ROI provides a ‘big picture’ of the investment return from start to finish.

- ROI doesn’t consider the amount and timing of returns, while IRR does – for example, there’s a big difference between receiving $10,000 per year for five years vs. $50,000 in year five.

- IRR is more difficult to calculate and depends on a number of variables, while ROI is easy to calculate but doesn’t consider the future value of money being invested.

How Rental Property Investors Calculate IRR and ROI

Now let’s take a look at an actual example of how rental property investors calculate IRR and ROI.

In this scenario, we’ll assume a single-family rental property was purchased for $100,000 cash and held for five years before being sold for a net sales price (after closing costs) of $125,000. The net annual income is $7,000 and the investor’s alternative ‘risk-free’ discount rate is 6%.

How to Calculate Rental Property ROI

Let’s start with ROI since it’s the easiest to calculate. The net sale price of the house is $125,000 and the total annual income is $35,000 ($7,000 per year x 5 years):

- ROI = Net income + Current value / Original value = ROI – 1 x 100

- $35,000 net income + $125,000 current value / $100,000 original value = ROI – 1 x 100

- $160,000 / $100,000 = 1.6 – 1 = .60 x 100 = 60%

So, from start to finish, the ROI on the rental property over the five-year hold time is 60%. If there was a higher than expected vacancy rate or capital repairs needed over the holding period, the ROI would be lower because the total net income would be less.

How to Calculate Rental Property IRR

To calculate the IRR, we use the original initial investment (purchase price) of $100,000 plus four years of $7,000 per year in net income. The net income in the fifth year is $132,000, which is the total of the net rental income of $7,000 for the full year plus the net sales price of $125,000:

- Initial investment = $100,000

- Holding period = 5 years

- Year 1 = $7,000

- Year 2 = $7,000

- Year 3 = $7,000

- Year 4 = $7,000

- Year 5 = $132,000 ($7,000 net rental income + $125,000 net sales price)

The IRR is 11.013%.

Our calculation also shows the gross return is 60% – the same percentage as our ROI – and the net cash flow is $60,000 ($35,000 for five years of net rental income + $25,000 net sales profit).

At the beginning of this section, we said the investor’s alternative ‘risk free’ discount rate was 6%. Because the rental property used in this example generates an IRR of 11.013% – nearly double the investor’s safe rate – investing in the house makes financial sense because the return is so much higher.

Calculating IRR with Uneven Cash Flow

In the real world of rental property investing cash flows sometimes aren’t the same from year to year. Vacancy may be higher than normal in a given year, or unanticipated repair expenses decrease net income.

With those variables in mind, let’s look at how the timing of cash flow affects IRR.

In this example, we’ll assume the investor needed to update the property in the first year. The rehab expense and lost income due to vacancy resulted in no cash flow in the first year, but generated higher net rental income for the remaining four years:

- Initial investment = $100,000

- Holding period = 5 years

- Year 1 = $0

- Year 2 = $8,750

- Year 3 = $8,750

- Year 4 = $8,750

- Year 5 = $133,750 ($8,750 net rental income + $125,000 net sales price)

The IRR has dropped down to 10.669% vs. 11.013% in the previous scenario.

Even though annual cash flow is higher, because there is no income the first year the time value of money reduces the overall IRR, while the ROI and total net cash flows remain unchanged.

Why Investors Use Both IRR and ROI

Both IRR and ROI calculations have their strengths and weaknesses.

ROI is an easy “back of the napkin” calculation but doesn’t take into account opportunity cost and the time value of money. IRR is much more complicated to calculate but provides a better idea of the long-term potential of a rental property investment.

Using both IRR and ROI gives real estate investors in-depth insight into the past, current, and potential future performance of a single-family rental property.

Oftentimes, ROI can be used to screen out property that isn’t a match for the investor’s strategy. Then, rentals that do make the cut can be further scrutinized with a detailed IRR calculation.